Understanding Debt Portfolio Management Services

Transform Your Financial Future

Contact UsWhen a debt suddenly shows up under a new company’s name, the confusion isn’t about money first. It’s about control. You want to know who’s handling your account and what changed without your input.

That uncertainty isn’t rare. Roughly one in three U.S. adults has been contacted by a debt collector, often after an account has been transferred or sold. That shift happens because unpaid accounts rarely stay in one place forever.

They move into structured systems designed to organize, verify, and resolve them instead of letting them drift unresolved. This is where debt portfolio management services enter your financial path. They act as specialized account managers who oversee transferred obligations, replacing disorder with clear ownership and defined next steps.

This article explores how debt portfolio management works, why these services exist, and how they shape realistic paths toward resolution when accounts change hands.

Key Takeaways

- Debt portfolio management services focus on structured, long-term solutions, replacing the chaos of traditional debt collection.

- Payment plans are customized to your financial situation, offering flexibility and ease over rigid, standard terms.

- These services prioritize transparency, legal compliance, and ethical practices, avoiding aggressive collection tactics.

- Debt resolution is accurately reported to credit bureaus, improving your credit over time.

- Forest Hill Management provides structured account support and compliant repayment options to help you manage obligations with clarity

What Debt Portfolio Management Services Actually Do

Debt portfolio management companies manage portfolios of accounts that may be transferred or assigned from original creditors. Unlike traditional collection agencies that only chase payments, these firms manage entire portfolios with systems built for documentation, compliance, and structured repayment.

For you, this shift means dealing with a company whose entire business model depends on finding workable solutions rather than applying maximum pressure. The economic incentive structure changes when your account moves into portfolio management.

With that understanding, let’s take a closer look at how these services actually operate.

How Debt Portfolio Management Services Operate

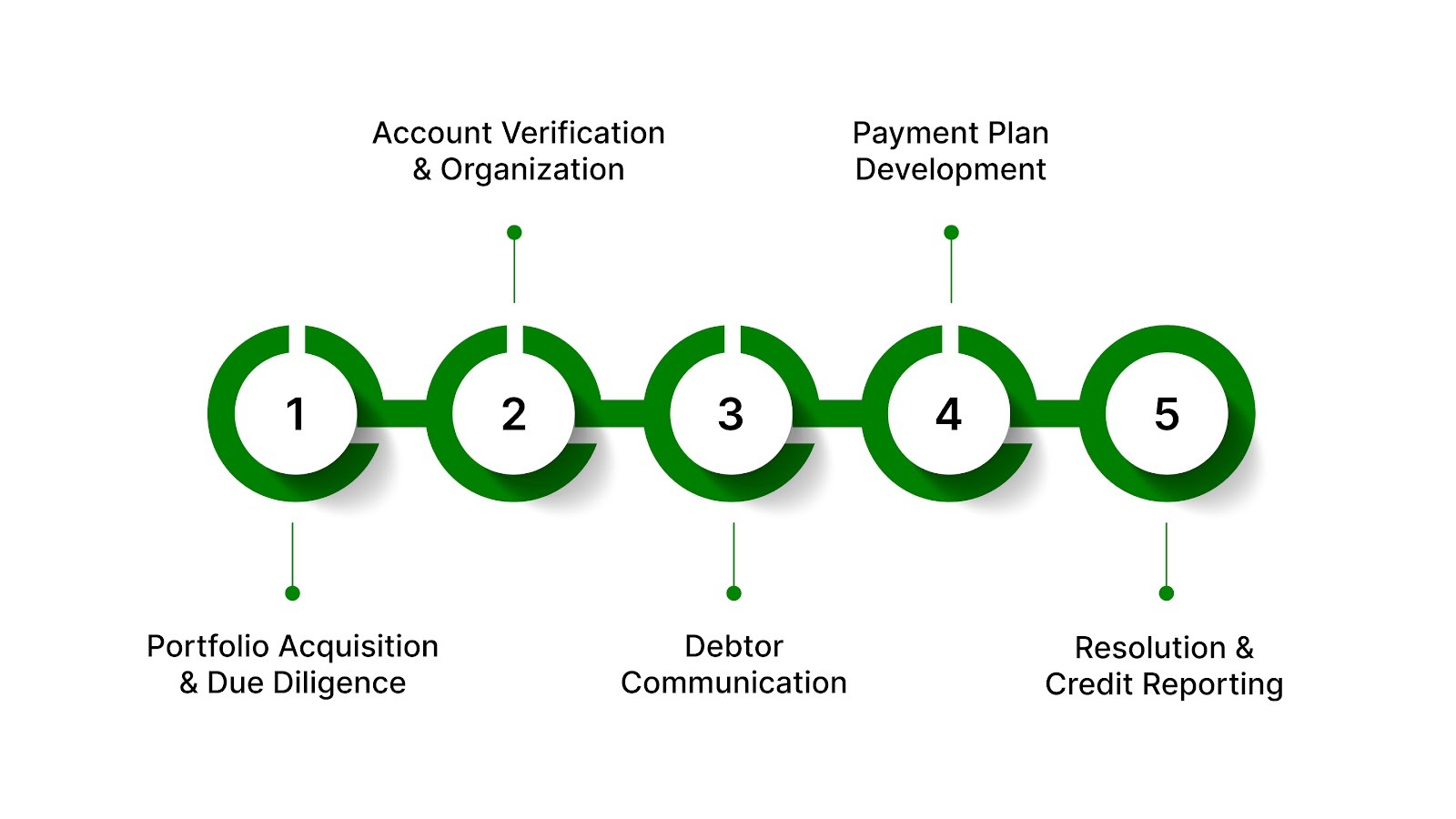

The transfer of your account triggers a sequence of internal processes designed to establish accuracy before any contact happens. These aren't random steps; each one builds the foundation for a legitimate resolution.

1. Portfolio Acquisition & Due Diligence

When a portfolio management company acquires accounts, they're buying financial obligations along with all associated documentation. This includes;

- Original loan agreements

- Payment histories, and

- Legal paperwork proving the debt exists

Due diligence happens before purchase to verify that each account is legitimate, legally collectible, and properly documented.

2. Account Verification & Organization

Once acquired, every account undergoes internal review to confirm balances, identify the last payment date, and flag any disputes or legal holds. Data gets organized into centralized systems that track every interaction, payment, and modification.

This means when you call, the person answering has your complete account history visible, not scattered notes across multiple platforms.

3. Debtor Communication

Initial contact follows legal guidelines under the Fair Debt Collection Practices Act. You'll receive validation notices, and outreach is based on account status. Communication channels, such as mail, email, or phone, are regulated to prevent harassment and shift to negotiation once you respond.

4. Payment Plan Development

Repayment options are presented based on account status and available arrangements. These options are designed to provide predictable, manageable payment structures. Flexible options allow small, consistent payments through secure systems, helping provide a structured path forward within the repayment process.

5. Resolution & Credit Reporting

When you complete a payment plan or settle an account, documentation gets filed confirming the resolution. This isn't optional. It protects both parties from future disputes. Portfolio managers report account status to credit bureaus, which means account status may be reported according to applicable credit reporting standards.

Also Read: How to Use the Avalanche Method to Pay Off Debt

Accurate reporting matters because it's the mechanism that eventually removes the debt's negative impact from your financial profile.

Services Offered by Debt Portfolio Management Companies

Beyond just managing the debt itself, these companies provide tools and support designed to make the resolution less chaotic. What they offer reflects the practical barriers people face when trying to resolve old accounts.

1. Account Verification & Balance Review

You can request a detailed breakdown showing how the current balance was calculated, including any interest or fees added since the original charge-off. This transparency lets you challenge incorrect amounts before making payments.

2. Customized Payment Plans

Repayment options are structured to provide consistency and align with account terms and available arrangements.

3. Settlement Options

If you can pay a lump sum, many portfolio managers accept less than the full balance to close the account immediately, which clears the obligation faster than long-term payment plans.

4. Secure Online Payment Portals

24/7 access through encrypted platforms means you control when and how you submit payments without waiting for business hours or dealing with phone representatives.

5. Financial Advisory Support

Account support teams explain available repayment options, clarify account details, and answer process-related questions.

6. Credit Reporting & Resolution

Once resolved, the account status updates across all three major credit bureaus, and you receive written confirmation for your records, which prevents future collection attempts on the same debt.

Now, let's explore the key benefits of working with these services and how they can make a significant difference in your journey to financial recovery.

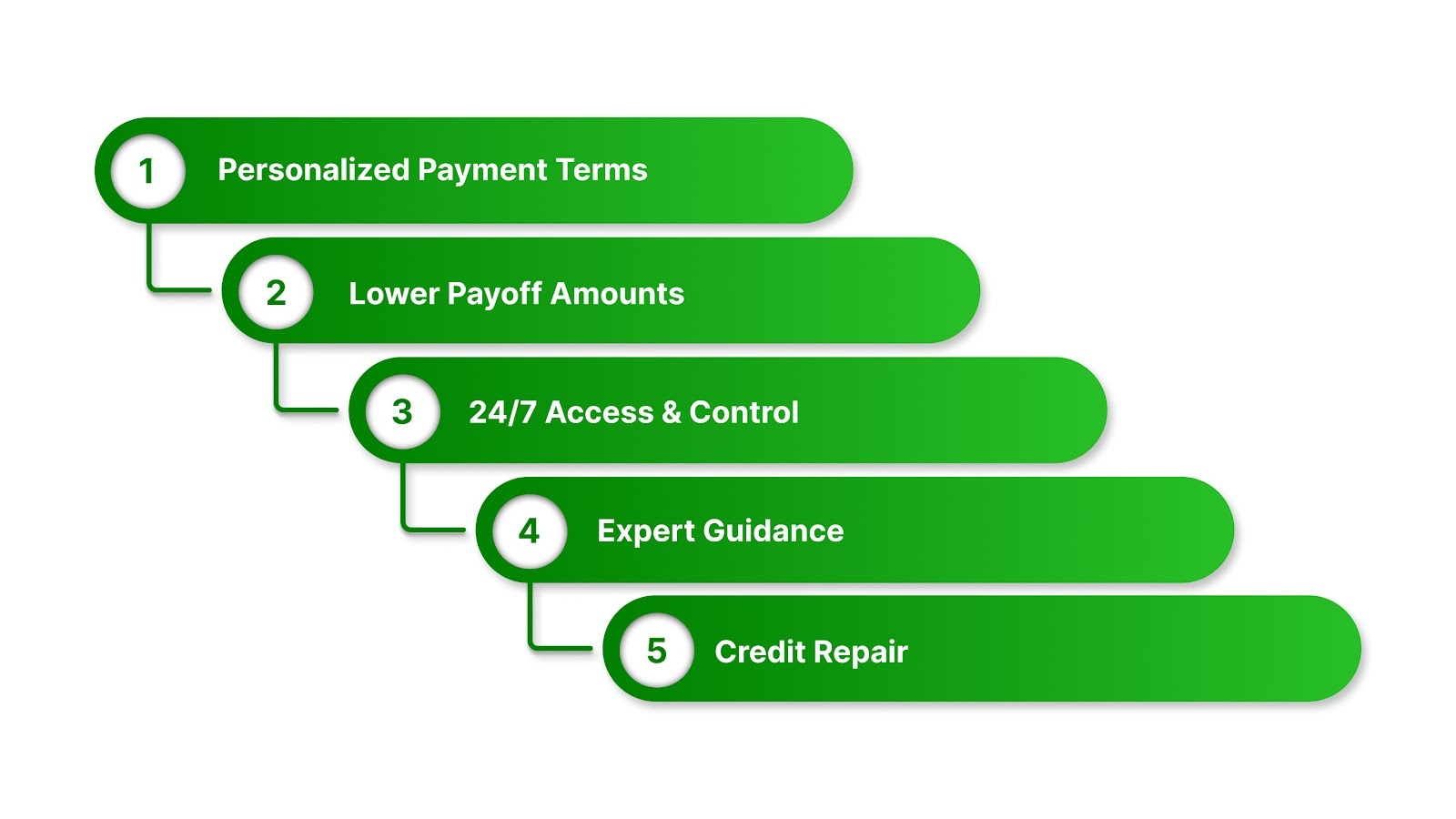

Key Benefits of Working with Debt Portfolio Management Services

Working with debt portfolio management services gives you flexibility and a clearer path to financial recovery. Here’s what you gain:

- Personalized Payment Terms: Flexible payment plans based on your unique financial situation, making repayment more manageable.

- Settlement Options: In some cases, alternative resolution arrangements may be available depending on account status.

- 24/7 Access & Control: Secure online portals allow you to manage payments and view account information at any time, removing the stress of waiting for answers.

- Clear Support: Knowledgeable support teams provide explanations of available options and next steps.

- Credit Reporting: Account status may be updated following resolution according to reporting policies.

These advantages set debt portfolio management apart from traditional debt collection methods. But what exactly makes working with a portfolio manager different from dealing with more conventional collection agencies?

Also Read: How Debt Stacking Can Accelerate Your Journey to Financial Freedom

Let’s take a closer look at how Debt Portfolio Management compares to Traditional Debt Collection.

Debt Portfolio Management vs Traditional Debt Collection

Not all debt collectors operate the same way. While both seek payment, portfolio managers and traditional collectors differ in methods and motivations. Understanding these differences helps you know what to expect.

Here's a quick comparison to highlight how debt portfolio management and traditional debt collection stack up:

Differences in structure shape how debt is managed. Portfolio managers succeed when the debt is resolved in a sustainable way, while traditional collectors focus on maximizing payment, often regardless of what’s feasible for you.

While ethical standards vary, portfolio management typically leans toward workable solutions rather than coercive tactics.

Also Read: Best Debt Payment Gateways and How They Work

Now that we’ve outlined the key differences between debt portfolio management and traditional collection methods, let’s take a look at how Forest Hill Management puts these principles into practice.

How Forest Hill Management Delivers Debt Portfolio Services

When you work with Forest Hill Management, you're not just paying off debt; you’re working with a company that emphasizes clarity, compliance, and structured account resolution. We've designed our services to remove barriers and add clarity to what can feel like an overwhelming process.

Here's what we offer:

- Secure online payments that fit your schedule, with no hidden fees, penalties, or pressure tactics

- Structured repayment options designed to provide consistency and transparency

- Direct access to knowledgeable account support teams who answer questions, explain your options, and provide guidance throughout your journey

- Transparent account information available 24/7 so you always know where you stand and what comes next

At Forest Hill, clear, compliant account management is our priority. We’re not just here to collect payments; we’re here to help you regain control of your financial life, one step at a time.

Conclusion

Debt management can be a complicated process, but understanding the role of debt portfolio management services gives you a clearer path toward resolution. These services help eliminate the confusion that often surrounds debt ownership and bring a more structured, proactive approach to addressing your financial challenges.

With the right support, you don’t have to face this journey alone. The key is finding a partner who treats your debt not as a transaction, but as part of your bigger financial picture. That’s where Forest Hill Management stands apart.

We provide a transparent, structured approach to managing accounts through clear communication and compliant processes.

Ready to take control of your financial future? Contact Forest Hill Management today to learn more about available repayment options.

FAQs

1. Can debt portfolio management companies negotiate with multiple creditors at once?

Some debt portfolio managers can manage multiple accounts within a portfolio, depending on ownership and servicing arrangements. This can help debtors simplify repayment by consolidating negotiations into a single, manageable plan rather than dealing with each creditor separately.

2. Can debt portfolio management affect my eligibility for new financial products?

Yes. While portfolio management resolves past debt, lenders sometimes review closed accounts when assessing new applications. Successfully completing a program may demonstrate financial responsibility, but certain accounts may remain visible in historical credit data for a limited time.

3. Are there tax implications when a debt is settled or forgiven?

If a portfolio manager agrees to a settlement for less than the full balance, the forgiven amount could be considered taxable income by the IRS. It’s wise to consult a tax professional before finalizing settlements to understand reporting requirements and avoid unexpected liabilities.

4. How does debt portfolio management interact with bankruptcy?

If you’re in bankruptcy or considering filing, portfolio managers follow legal requirements when accounts are subject to bankruptcy proceedings to ensure any claims or repayment plans are legally recognized. They may also pause collection activity until your bankruptcy case is resolved.

-p-500%20(1).png)